You are here:Aicha Vitalis > markets

The Profitability of Mining Bitcoin: A Comprehensive Analysis

Aicha Vitalis2024-09-21 08:17:40【markets】2people have watched

Introductioncrypto,coin,price,block,usd,today trading view,In recent years, Bitcoin has become one of the most popular cryptocurrencies in the world. As a resu airdrop,dex,cex,markets,trade value chart,buy,In recent years, Bitcoin has become one of the most popular cryptocurrencies in the world. As a resu

In recent years, Bitcoin has become one of the most popular cryptocurrencies in the world. As a result, the demand for mining Bitcoin has surged, with many individuals and companies investing in mining equipment to secure their share of the digital currency. However, the profitability of mining Bitcoin is a topic of great interest and debate among potential investors. This article aims to provide a comprehensive analysis of the profitability of mining Bitcoin, taking into account various factors that can impact the success of a mining operation.

The first factor to consider when evaluating the profitability of mining Bitcoin is the cost of electricity. Mining Bitcoin requires a significant amount of computing power, which in turn consumes a substantial amount of electricity. The cost of electricity can vary greatly depending on the location of the mining operation. In some countries, electricity is cheaper, making mining Bitcoin more profitable. Conversely, in countries where electricity costs are high, the profitability of mining Bitcoin may be significantly reduced.

Another critical factor is the cost of mining equipment. The price of mining equipment has been on a steady rise as demand for Bitcoin has increased. The initial investment in mining equipment can be substantial, and the cost of maintenance and upgrades can also be a significant financial burden. However, as the price of Bitcoin rises, the potential profit from mining can offset these costs, making the investment worthwhile.

The difficulty of mining Bitcoin is another crucial factor that affects profitability. The difficulty of mining is a measure of how challenging it is to solve the cryptographic puzzles required to mine new Bitcoin. As more miners join the network, the difficulty increases, making it more challenging and expensive to mine Bitcoin. This means that the profitability of mining Bitcoin can fluctuate significantly based on the current difficulty level.

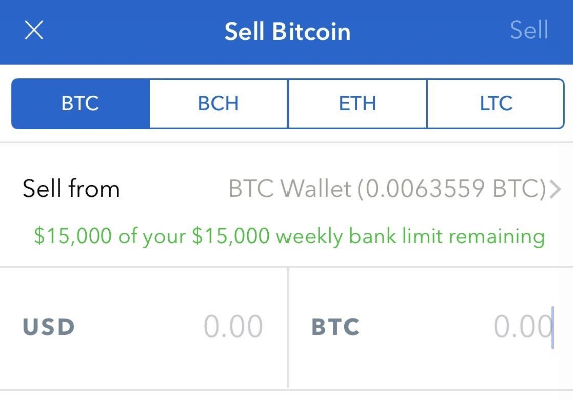

The price of Bitcoin is also a significant factor in determining the profitability of mining. As the price of Bitcoin rises, the potential profit from mining increases, making it more attractive for new miners to enter the market. However, as the price of Bitcoin falls, the profitability of mining can decrease, making it less appealing for miners to continue their operations.

Another factor to consider is the efficiency of the mining equipment. The efficiency of a mining rig is measured by its hash rate, which is the number of hashes it can perform per second. A higher hash rate means that the rig can solve more cryptographic puzzles and, therefore, mine more Bitcoin. However, a higher hash rate also means that the rig consumes more electricity, which can impact the overall profitability of the mining operation.

In conclusion, the profitability of mining Bitcoin is influenced by several factors, including the cost of electricity, the cost of mining equipment, the difficulty of mining, the price of Bitcoin, and the efficiency of the mining equipment. While mining Bitcoin can be a lucrative venture, it is essential to carefully consider these factors before investing in mining equipment. As the cryptocurrency market continues to evolve, the profitability of mining Bitcoin will likely change, making it crucial for miners to stay informed and adapt to the changing landscape.

This article address:https://www.aichavitalis.com/blog/42f17299785.html

Like!(5284)

Related Posts

- Binance Chain on Ledger: A Secure and User-Friendly Crypto Experience

- Free Bitcoin Mining Without Fee: A Guide to Legitimate Opportunities

- Bitcoin Price Last Year 2019: A Look Back at the Cryptocurrency's Turbulent Journey

- Title: Transfer Bitcoin Wallet with Seed Phrase: No Balance Required?

- How to Use Binance to Trade: A Comprehensive Guide

- Binance Leveraged Trading: A Game-Changing Approach to Cryptocurrency Trading

- Why Do I Have Bitcoin Cash in My Wallet?

- What is the Price of Bitcoin When It Started?

- Can I Buy Bitcoin with a Cashiers Check?

- What is the Price of Bitcoin Today: A Comprehensive Analysis

Popular

Recent

Bitcoin Price Before and After Halving: A Comprehensive Analysis

Binance Min Withdrawal: Understanding the Minimum Withdrawal Limits on Binance

Bitcoin Interest Web Wallet: The Ultimate Solution for Secure and Convenient Cryptocurrency Management

### Linode Bitcoin Mining: A Comprehensive Guide to Harnessing Cloud Power

Bitcoin Wallet BTC Echo: A Comprehensive Guide to Secure and Efficient Cryptocurrency Management

Bitcoin Price Dividend: The Potential of Cryptocurrency Dividends in the Bitcoin Era

The Rise of ZEC BTC Binance: A Game-Changing Cryptocurrency Partnership

Buy Bitcoin Compare Prices: The Ultimate Guide to Finding the Best Deals

links

- ### Black Friday Bitcoin Wallet Deals: Secure Your Cryptocurrency This Season

- Bitcoin vs USD Price: A Comprehensive Analysis

- How Can I Sell CTR in Binance?

- Bitcoin Wallets in 2015: A Comprehensive Overview

- Cash is Trash, Bitcoin: The Future of Money

- Binance Wallet Address Example: Understanding the Basics

- Title: Understanding the Binance Smart Chain RPC URL: A Comprehensive Guide

- When is Bitcoin Cash Halving 2024?

- Binance Alice Coin: A New Cryptocurrency on the Rise

- Ever Grow Coin Binance: A Promising Investment Opportunity in the Cryptocurrency Market